Verve is a credit card from Continental Finance specializing in credit cards for consumers with less than perfect credit. The company has an impressive customer base of over 3 million people when writing this article. In addition to consumer credit cards, Verve offers business credit cards for small businesses. Verve offers 0% APR for purchases or fund transfers for 18 billing cycles. We offer one of the most extended introductory periods in the industry at 0% for six months.

Upon completing the initial phase, you will see that the APR varies from 15.24% to 29%.

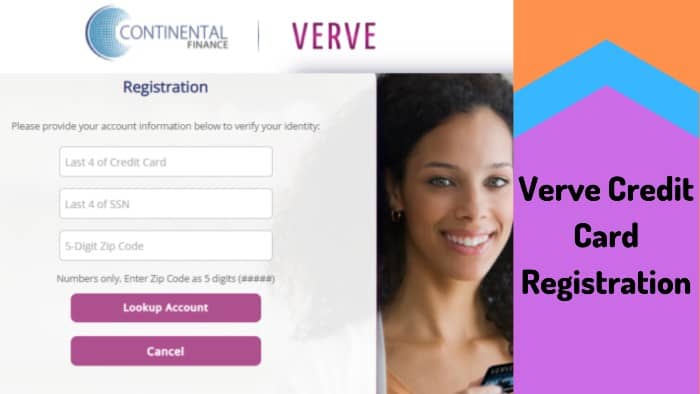

Registration Procedure At www.yourcreditcardinfo.com

Before using all functions, you must first register on the Verve Credit Card login page. It’s easy to write. The following is a step-by-step procedure.

- Visit the website (www.yourcreditcardinfo.com)

- Click the “Register Now” tab just below the registration button on the registration page.

- Enter the last four digits of your Verve credit card, the last four digits of your social security number, and your birth date/zip code, and click the Find Account tab.

Guide To Verve Credit Card Login

With a Verve credit card, you can improve your credibility. You can improve your credit rating by paying your bills on time. To keep track of your account and pay your bills quickly, you should log in to the official website. The following steps can help you log in to your Verve Credit Card Login Portal.

Step 1: In your browser, enter the website (https://www.vervecardinfo.com/) and visit the indicated website.

Step 2: Search for “Verve Credit Card Login” or click here to open the login page.

Step 3: Enter your information, like username and password.

Step 4: Click login, and you can manage your account.

What Are The Requirements For Verve Credit Card Login?

Signing up for the Verve credit card requires the user to have a few things on hand. Following are the registration requirements:

- Internet: To log into Verve Card, you must have an Internet connection.

- Electronic Device: The user can use any electronic device, such as a computer, laptop, or smartphone.

- Active account: Online account management login is required to go online. It’s free to create an account if you don’t already have one.

- Personal Device: You must use a remote device to log into the account. In this way, you can protect your financial information and save your passwords.

- Visit the website: To access the Verve Credit Card login page, visit the following website: (yourcreditcardinfo.com or https://www.vervecardinfo.com/).

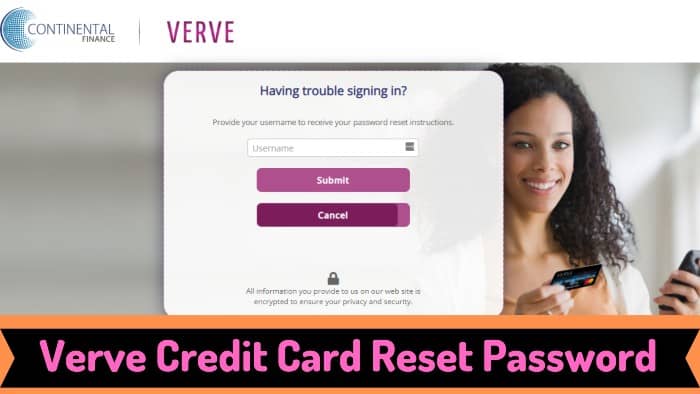

Reset Your Username And Password

You could follow these simple steps to retrieve your password or username if you forgot.

- Visit the website (wwwyourcreditcardinfo.com or https://www.vervecardinfo.com/)

- Click Connect.

- Go to the official Verve Credit Card login page and click “I forgot my password or username” under the “Login” button.

- The page will show two options, one for password reset and one for username. Depending on the problem, click on the options.

- Click the “I forgot my password” link if you want to reset your password.

-

- Please enter your username after clicking the Forgot my password link.

- The Continental Finance Verve Credit Card Login Portal will send you an SMS with a link to reset your password.

-

- If you click on “I forgot my username,” you will be asked to confirm on the next page.

- Please enter the last four digits of the social security number, last digit of the card, date of birth, and zip code.

- Then click on the Find Account option below the form.

- All information will appear, and you can follow the steps to change your username.

- Click Submit.

How To Apply For Verve Credit Card?

You can apply for the Verve credit card only after being offered one. Continental Finance website allows you to accept the offer via email if any. After receiving your offer in the mail, many people have questions about how to apply for the Verve credit card. The steps to apply for the Verve credit card are as follows:

- Launch your web browser to search https://continentalfinance.net/single_card_info

- On the top home page, scroll down to Credit Cards

- Click here to find Apply Now

- Check verve credit cards and order them according to your needs

- Quickly enter information in the columns provided

- Read and accept the General Conditions

- Finally, apply for the credit card using the Apply button.

Verve Credit Card Activation

The steps to activate your Verve credit cards for the first time are as follows:

- Visit the website (www.yourcreditcardinfo.com)

- Click “Activate my card.” After clicking the Activate My Card button, the website will take you to the Verve Card Activation Portal.

- Enter the following credentials to activate your card.

- The last four digits of your account number with Verve credit cards, your social security number

- Five-digit postal code

- After entering your login details above, click Activate my card.

Verve Credit Card Payment Methods

Method 1: Payment Through Online

The online payment option allows you to pay your credit card bills. You can make your payment online by logging into your account (listed above). You can then click on the payment option and complete the payment process. That way, you can complete your Verve Credit Card payment.

Method 2: Payment By Cash Or Cheque

If you want to pay by cash or cheque, you can go to the nearest Verve store. You can request a credit at the check-in desk. In this way, you can pay your credit card bills offline.

Method 3: Payment By Calling On Verve Credit Card Customer Service Number

You can find your Verve customer service in your web browser. You can call them and follow the steps to make your credit card payment. We also mentioned the customer support number in this article.

Method 4: Payment By Mail

You can pay your credit bill by mail. You need to add the check or cash and mail it to your business mailing address.

Benefits Of Verve Card

You Can Get The Offer With No Monthly Fee: You can get an offer where you get a credit limit of $750, an annual fee of $99 with no monthly fee.

Free Credit Score: Cardholders receive a free Vantage 3.0 score from Experian when signing up for eStatements.

Mobile App: Verve has a mobile app (which, while well known among major card issuers, is rare among high-risk card issuers).

Cashback Available To Some Customers: Some customers may receive 1% cashback on their offer. You can redeem the discount for bank statements.

Account Verified For Credit Limit Increase After Six Months: Verve will ascertain whether you’ve paid your bills on time within the first six months.

No Credit Limit Doubling After Six Months: Other continental finances like Reflex and Surge will double your credit limit six months after making your minimum payment on time. As they have similar fees, it is best to get these cards.

Tools And Resources At CFC Verve

Online Account Management

You can manage your Vever credit card account online by logging into Web Access. If you are a Verve user, you can view detailed information about your purchases and payments and all transactions that Verve reports to major credit bureaus.

Complimentary VantageScore

In addition to Continental Verve eStatements, you also receive a free Vantage Score, which third-party service lenders use to assess your credibility. The Continental Finance Verve credit card updates your score every 30 days, so you can easily track how your score has changed over time.

Credit Protection

As part of the Continental Verve Loyalty Rewards program, the Verve credit card provides an extra layer of security for your Verve and adds additional protection to your score.

| Official Site | Verve Credit Card |

|---|---|

| Mobile Application Available | Yes |

| Country | USA |

| Application Required | Yes |

| Managed By | Continental Finance Company |

Customer Service Centre

Customers can call the Verve Credit Card Customer Service Center with any questions or complaints about Verve Credit Cards. Continental Credit (Verve) customer service representatives can advise you if you have any questions or want to complain about fraud, refunds, payments, etc.

If you need to contact support for your Verve Mastercard, you can log into your Verve Card account and submit a request online or request immediate assistance at 1-866-449-4514. Verve credit card customers can reach customer service between 7 am and 11 pm on weekdays between Monday and Friday and between 8 am and 8 pm on weekends from Saturday through Sunday. The Verve Credit Card call center team will be happy to answer your questions and complaints about the phone. Below is a list of Verve Credit’s toll-free customer service numbers and mailing addresses:

- Lost or Stolen Card: 1-800-556-5678

- Customer Service and Automated Account Information: 1-866-449-4514

- Payments: 1-800-518-6142

- Mail – Inquiries: Verve Card, P.O. Box 3220, Buffalo, NY 14240-3220

- Mail – Payments: Verve Credit Card, P.O. Box 31292, Tampa, FL 33631-3292

- Online Account Access: www.vervecardinfo.com

CFC Mobile Access Mobile App For Cardholders

The CFC Mobile Access application applies to credit card holders. Continental Finance Company launches this app for Verve credit card users who want to make credit card transactions online. You can register, apply, login, reset your credentials, check your credit and make your payment through this app. The functionalities of the CFC Mobile Access application are as follows:

- A quick view of your account summary, including your credit card balance, your remaining balance for the month, your next payment is due, and a helpful notification if you’ve exceeded your limit or are late.

- Make payments or schedule them for later.

- List of recently registered and pending transactions.

- File all your previous statements.

- Account information we maintain for your account with the ability to edit contact information.

- I was lost/stolen card recovery/replacement service.

About Continental Finance Verve

Founded in 2005, Continental Finance Company (“CFC”) is one of America’s leading credit card merchants and service providers for financially insecure consumers. Since its inception, CFC has held itself to its corporate responsibilities in a comprehensive customer service program, fair dealings, and responsible lending.

At CFC, we understand the importance of helping customers use credit responsibly. Our clients receive the best service available, including all the training tools necessary to manage their loans successfully.

The Continental Finance Verve Credit Card is a credit card that people with bad credit can use. Once approved, you will need to pay an annual $125. If approved, the charges will go straight from your credit limit. The annual fee is $96 starting in the second year. Also, you have to pay $5 a month for maintenance. The yearly percentage collection rate is 29.9%. Your credit limit will likely be $500 if your application is approved. However, you are left with $375 because you lost $125 in the first free year.

Frequently Asked Questions

What Is Information Required When I Proceed For Yourvervecard com Application Online?

You must provide personal information to the Yourvervecard online application, including:

- Full name

- Social Security number

- Birth date

- Physical address (no PO box)

- Estimated gross monthly income

Why Do You Need My Personal Information For My Credit Card Application?

We need your data for two reasons:

- Federal law requires us to collect, verify and record information identifying each person who opens an account. Therefore, we must collect your data for identification purposes.

- We use your data, such as your social security number, to retrieve data from your credit reporting agency and other information. Monthly income will be necessary to process your application.

Where Can You Use Your Verve MasterCard?

A Verve Mastercard with an initial credit limit ranges from $300 to $1,000. Use your Verve Card anywhere Mastercard is accepted.

Conclusion

The verve credit card allows you to verify your creditworthiness, financial credibility, bill payments, purchases in retail stores and malls, etc. It has a website where you can sign up or register online, log in with your Verve Credit Card login ID and password, and reset your credentials if you have them.

Applicants interested in this card should read Verve credit card reviews before applying. Applicants review and decide whether or not to accept the card application offer based on Verve credit card reviews from existing or past customers. It can be partially secured, fully secured, or wholly unsecured, depending on your credit status.